CREDIT CARD DEBT CONSEQUENCES

What Happens if You Don’t Pay Your Credit Card Debt?

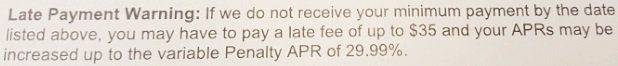

As the country experiences challenging economic times, many people find themselves burdened with substantial credit card debt. If you're unable to continue making credit card payments or choose not to file for bankruptcy, you'll have to face the consequences of credit card debt. So, what exactly happens if you can't pay off your credit card debt?

After a few months of non-payment, your debt will be transferred to a collection agency. These agencies will start their collection efforts by calling and mailing notices to your home, aiming to collect payment. It's important to note that collection agencies have the right to contact your family and even your place of employment in order to reach out to you for debt collection purposes.

Under the Fair Debt Collection Practices Act, you have a grace period of 30 days before a collection agency can report the delinquent account on your credit report. This can have long-lasting effects on your creditworthiness, potentially hindering your ability to obtain credit in the future until the debt is settled.

Furthermore, if the debt remains unpaid even after a civil court judgment is filed against you, the creditor or collection agency can take further action. They may place liens on your wages and assets, garnishing your wages and seizing your assets to cover the debt. In some cases, they may even garnish your bank account, legally withdrawing funds to satisfy the outstanding balance.

So what happens if you can’t pay your credit card debt?

Missing a credit card payment can have significant consequences. After a few months of non-payment, your debt may be placed with a collection agency. These agencies will make relentless attempts to collect payment by contacting you through phone calls and mail notices. They may even reach out to your family and place of employment in their pursuit of debt collection.

It is important to note that the Fair Debt Collection Practices Act grants you a 30-day grace period before the collection agency can report the delinquent account on your credit report. This reporting can hinder your ability to obtain future credit until the debt is paid off. Additionally, if the debt remains unpaid, a creditor or collection agency can take legal action and obtain a civil court ordered judgment against you. This judgment signifies your responsibility to repay the debt and can have serious repercussions.

One such consequence is the placement of liens on your wages and assets. If the debt remains unpaid even after the judgment, the creditor can garnish your wages, withdraw funds from your bank account, and place liens on your assets. These measures are legally permitted and aim to ensure the repayment of the outstanding debt.

While the consequences of credit card debt can be overwhelming and stressful, it is important to understand that failing to pay credit card debt, no matter how outstanding, is not considered a crime in the United States. However, the financial and legal implications can be severe and should not be taken lightly.

It is crucial to stay proactive and address credit card debt as soon as possible to avoid worsening consequences. Communication with creditors or collection agencies, seeking professional advice, and exploring debt repayment options can help alleviate the burden and pave the way towards financial recovery.

How Do I Dig My Way Out?

Filing bankruptcy or initiating a debt consolidation plan will stop collection agents from harassing you. Working with one of our bankruptcy lawyers means the collection agency is forced to deal with us, not you.

Our bankruptcy law firm coordinates a debt consolidation or repayment plan that’s mutually beneficial to you and your creditors.

We’ll also prevent creditors from taking you to civil court.

Credit Solutions stops creditor harassment, and protects your future credit and assets.

Setup a FREE consultation with to discuss your credit card debt situation; Just tell us how to contact you and we’ll get in touch shortly.